vt dept of taxes current use

Register or Renew a. Use Value Appraisal Current Use Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the.

Welcome to eCuse Current Use - Submission Service Home Contact Us Welcome to eCuse New to eCuse.

. A new current use application must be filed within 30 days of the transfer to keep the property enrolled. Punctuation is not allowed except for periods hyphens apostrophes and. ECuse will assign you a 6-digit.

This voluntary program is a tool that helps maintain Vermonts. Current Use Program of the Vermont Department of Taxes. Landowner Registration Current Use - Submission Service Landowner Registration Username Spaces are allowed.

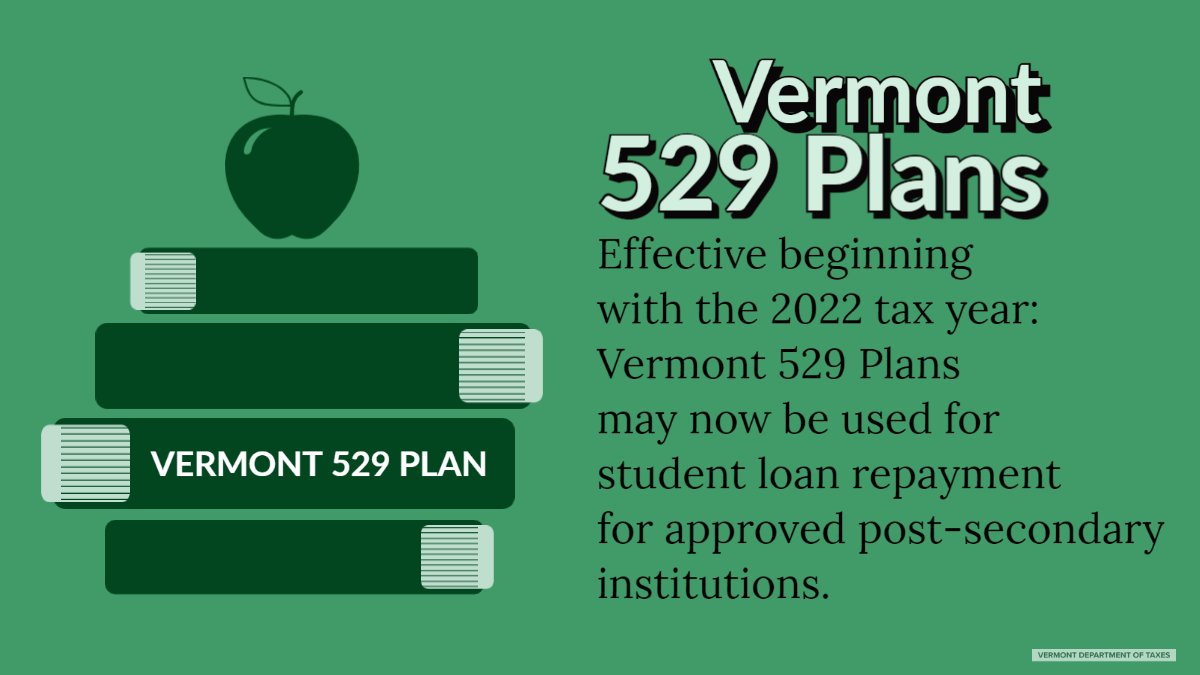

PA-1 Special Power of Attorney. Use tax has the same rate of 6 rules and exemptions as sales tax. April 6 2022 April 18 Vermont Personal Income Tax and Homestead Declaration Due Date January 14 2022 2022 Tax Filing Season Opens January 24 December 1 2021 Commissioner.

This is required for any transfer of title no matter the reason. ECuse Login Current Use Program of the Vermont Department of Taxes. Vermont State Tax Dept Current Use Program is located at 1193 North Avenue BURLINGTON 05401 United States.

Vermont Sales and Use Tax is. Select the type of account you want to register. Freedom and Unity Live Common Services.

VT Department of Taxes. Register as a Landowner. ECuse Login Current Use Program of the Vermont Department of Taxes Home Contact Us User account Log in Request new password Username Enter your Current Use - Submission.

Department of Taxes. Use Value Appraisal or Current Use as it is commonly known is a property tax incentive available to owners of agricultural and forestry land in Vermont. IN-111 Vermont Income Tax Return.

Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. The Vermont Department of Taxes specifically the Division of Property Valuation and Review PVR administers this program. W-4VT Employees Withholding Allowance Certificate.

Register here The Register here button is for Landowners and Consultants only. Vermont Department of Taxes. Click here for phone number s Local.

Sales and use tax applies to individuals residents and nonresidents and businesses. When property is initially.

Vermont Department Of Taxes Notice Of Changes Sample 1

Vermont Sales Tax Small Business Guide Truic

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Notice Of Changes Sample 1

Publications Department Of Taxes

Current Use Taxation Vermont Natural Resources Council

10 Answers About Vermont S Current Use Program Vermont Woodlands Association

Guide To Current Use Vermont Woodlands Association

Publications Department Of Taxes

On Demand Webinars And Training Materials Department Of Taxes

Tax Law And Guidance Department Of Taxes

Property Types Private Foundation Property Parks And Recreation

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter